The Bitcoin price rally paused today, with investors focused on the upcoming US CPI inflation data. The pause also reflects market experts’ expectations that BTC will see a slight pullback before showing more gains in the coming days. However, Peter Brandt is creating optimism in the market by pointing to an uptrend for BTC.

Will Bitcoin price hit $327,000?

In a recent X post, veteran trader Peter Brandt shared an optimistic view on Bitcoin price, suggesting that the crypto could reach new highs in the coming days. Brandt shared a chart with two possible price paths for BTC: $134,000 and $327,000. In this chart, he presented two potential scenarios that could determine where the leading crypto could be headed. For context, some believe that Bitcoin has reached an overbought level, in which case $134,000 could be BTC’s next target. However, many in the crypto community believe that BTC price is just starting to trend upwards, meaning $327,000 could be the next target.

In particular, Brandt, who included both bullish and bearish possibilities in his analysis, highlighted the high target of $ 327,000, which attracted the attention of investors. In addition, the two-way price range offered by the chart suggests that there may be significant fluctuations on the road ahead of BTC; however, an exit movement could push the price beyond its recent peaks. While the lower target of $ 134,000 seems more realistic, the leading crypto may also consider the higher range target in the long term. In particular, a clear crypto regulatory roadmap in the US and a crypto-friendly regulatory institution under Donald Trump are thought to help continue the recent crypto market rally. In addition, Brandt recently predicted that BTC could reach $ 200,000. This prediction also coincides with the perspective of Bernstein analysts who predicted a similar rise.

Are there challenges ahead for BTC?

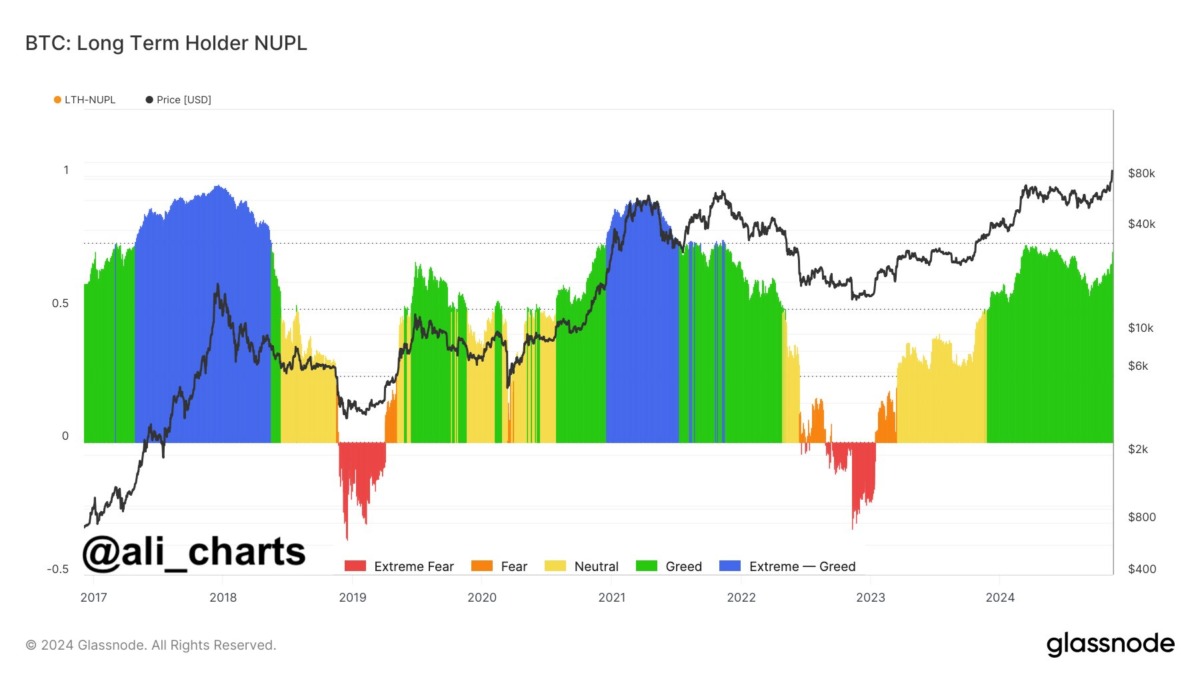

While Peter Brandt remains optimistic about the Bitcoin price, other market analysts remain cautious about fluctuations caused by the US CPI and other macroeconomic factors in the short term. Leading crypto analyst Ali Martinez noted on X that long-term Bitcoin holders are not showing “excessive greed” despite BTC’s recent price increases. This cautious stance generally indicates a level of confidence and stability among long-term holders that signals overall market sentiment and future price sustainability. Martinez’s comment is in line with Brandt’s view of a potential rally, but he sees a gradual buildup of momentum rather than an immediate rally.

However, the short-term outlook is clouded by the upcoming US CPI inflation data, which could affect investor sentiment across financial markets. Many experts expect a short-term pullback in BTC prices as investors digest economic updates and prepare for possible rate cuts from the Fed. Meanwhile, BTC prices fell more than 2% today to $87,540, with trading volume down 14% to $119 billion. However, the crypto touched a 24-hour high of $89,915.57 after reaching a weekly high of $89,956. Additionally, BTC futures open interest has fallen by nearly 3 percent in the last 24 hours, suggesting that investors are choosing to stay on the sidelines ahead of critical economic data.

To stay up-to-date with the breaking news, follow us on Twitter, Facebook, and Instagram. Join our Telegram and YouTube channel